|

|

Contextual Learning Portal Explore and analyze the stock market from a quantitative and qualitative perspective considering all things macroeconomics.

Basics- Project TitleExplore and analyze the stock market from a quantitative and qualitative perspective considering all things macroeconomics.

- Employer SitePlimoth Investment Advisors/ BayCoast Bank

-

Web Link: Plimoth Investors Advisors - Submitted By (Teacher Name)Judith A. Lima

- SchoolNew Bedford High School

- Brief Description and RationaleStudents will explore and analyze the dynamic stock market. They will analyze stocks as an investment from both a quantitative and qualitative perspective. Students will also analyze key economic data such as unemployment data, jobless claims, manufacturing data, consumer confidence data, and inflation data and apply the findings to financial markets. Finally they will assess the importance of investing and its relativity to financial planning.

- Grade Level11 or 12

- Materials / ResourcesStudent computers with internet access

Student graphic organizers

Access to Excel

Printer/Paper

Calculate gain or loss of a stock guide

Website listing for research and analysis

- Duration of lessonThis Unit Lesson will take 7-52 minute class periods.

- Pre-Requisite Knowledge*General knowledge about financial institutions, such as banks, credit unions, investment banks, and insurance companies.

*Knowledge about the Federal Reserves; its function, policies, and structure.

*General knowledge with concepts such as finance, budgeting, spending, saving,loans,insurance,investing.

*Understanding if SMART Financial Goals

*General Knowledge on how to use EXCEL

• W - Strategies to promote equityConsider lesson plan design, access to technology and tools, any additional supports for students.

- Instructional ObjectivesStudents will be able to...

* Differentiate between bank products such as savings accounts and certificate of deposits as compared to stocks, bonds, and mutual funds.

* Identify the major financial markets

* Describe investments concepts and risks associated with investing.

* Look up information on a stock

* Analyze information provided on stocks- growth investments.

* Evaluate how liquidity and volatility factor in the analysis of a growth investment

** Explain how to buy a stock

** Calculate the number of shares they can purchase with their initial investment

** Calculate the gain loss of a stock

** Understand the concept of a paper loss

**Conduct qualitative research on a company

* Synthesize information

* Write an Executive Summary about the company which includes Corporate Earnings; Industry/Business Summary, Economic Trends, Management Execution, and Valuation.

Lesson #1 | What are investments? How are they different from products that you can get at a bank such as savings accounts, mutual funds, certificate of deposits, etc?

- Lesson Plan 1 Topic

What are investments? How are they different from products that you can get at a bank such as savings accounts, mutual funds, certificate of deposits, etc?

- Lesson plan 1 objectivesStudents will be able to...

* Differentiate between bank products such as savings accounts and certificate of deposits as compared to stocks, bonds, and mutual funds.

* They will identify the major financial markets

* Describe investments concepts and risks associated with investing.

- Anticipatory set or lesson opening (to activate students` prior learning or draw student interest or involvement)To launch the lesson student will do an I see It Means in collaboration with think write pair share.

Students will be shown images representative of investing and the financial markets and initially write and share what they think the collective images mean,

In pairs they will compare ideas, question each other, and discuss.

We will then transition to whole group discussion and together put the pieces together to come up with a comprehensive understand of the outline for the learing that we will unpack of all things Investments! -

View/Download File: /project759_0325/I_Se_It_Means_Lesson_Investments_Launch_.pdf - Direct Instruction10 Minute lecture: To activate prior knowledge provide essential question: "How is an investment different than having money in the bank in a savings account or a cd?

Students will be introduced to the two main types of investment products; income investments and growth investments. I will explain that this lesson focuses on growth investments which include stocks, bonds, and mutual funds.

I will remind students that based on their financial goals that they have previously learned about, they will see the correlation and importance of how growth investment products can help them meet their financial goals.

After a facilitated conversation, students will watch Warren Buffet, How to invest for beginnings (7 Principles of Investing -

Web Link: Warren Buffett: How To Invest For Beginners - YouTube - Guided PracticeStudents will be given a graphic organizers to complete. They will work in pairs to complete and will then transition to whole group instruction.

-

View/Download File: /project759_0325/Graphic_Organizer_Investments.pdf - Independent Practice/Differentiated ActivitiesStudents will conduct research to add to their foundation of what is an investment. They will have to make two claims relative to investing and provide site sources.

To accommodate students‘ IEP and meet the needs of Ell students, I will provide 2 sources that they will go to. In addition I will given them an outline which will include sentence starters.

-

View/Download File: /project759_0325/Growth_Investments_vs_Income_Investments.pdf - Reflection on Employability SkillsWhether a student has interest in going into the world of finance or banking, critical thinking skills are essential in every job.

In addition, as students begin to understand and learn about the importance of planning for their future and their retirement, learning about investment vehicles will be essential. - Lesson ClosureWe will circle back to opening essential question and students will all record their answers in Microsoft teams. This is how I will check for understanding individually and students will share out to fill in any gaps.

- Summative/end of lesson assessmentStudents will write a 2 paragraph essay differentiating growth vs income investments. They will need to include analysis and evidence explaining why they would choose one investments over the next.

The second part of this essay will launch us into the next lesson. - References / Resources / Teacher PreparationThe U.S. Banking System South-Western 2017, 2010 Chapter 12,3, 5

Lesson plans were authored based on the collective information and knowledge obtained through working with Plimoth Investment Advisors and BayBoast Bank https://www.plimothinvestmentadvisors.com/home/home

Lesson #2 | Unpacking the the quantitative analysis of a stock- Lesson Plan 2 TopicUnpacking the the quantitative analysis of a stock

-

Web Link: What Is Stock Market Volatility? - YouTube - Lesson Plan 2 ObjectivesStudents will be able to:

* Look up information on a stock

* Analyze information provided on stocks- growth investments.

* Look at why someone would buy one stock over the next.

* Evaluate how liquidity and volatility factor in the analysis of a growth investment

- Anticipatory set or lesson opening (to activate students` prior learning or draw student interest or involvement)I will put up the attached listing of companies and facilitate a discussion. I will ask students` to think about all the companies that they know about and then have them consider if they would ever consider owning a piece of the company. They will all make a list of 15 companies.

Students will share out and we will create a class list. -

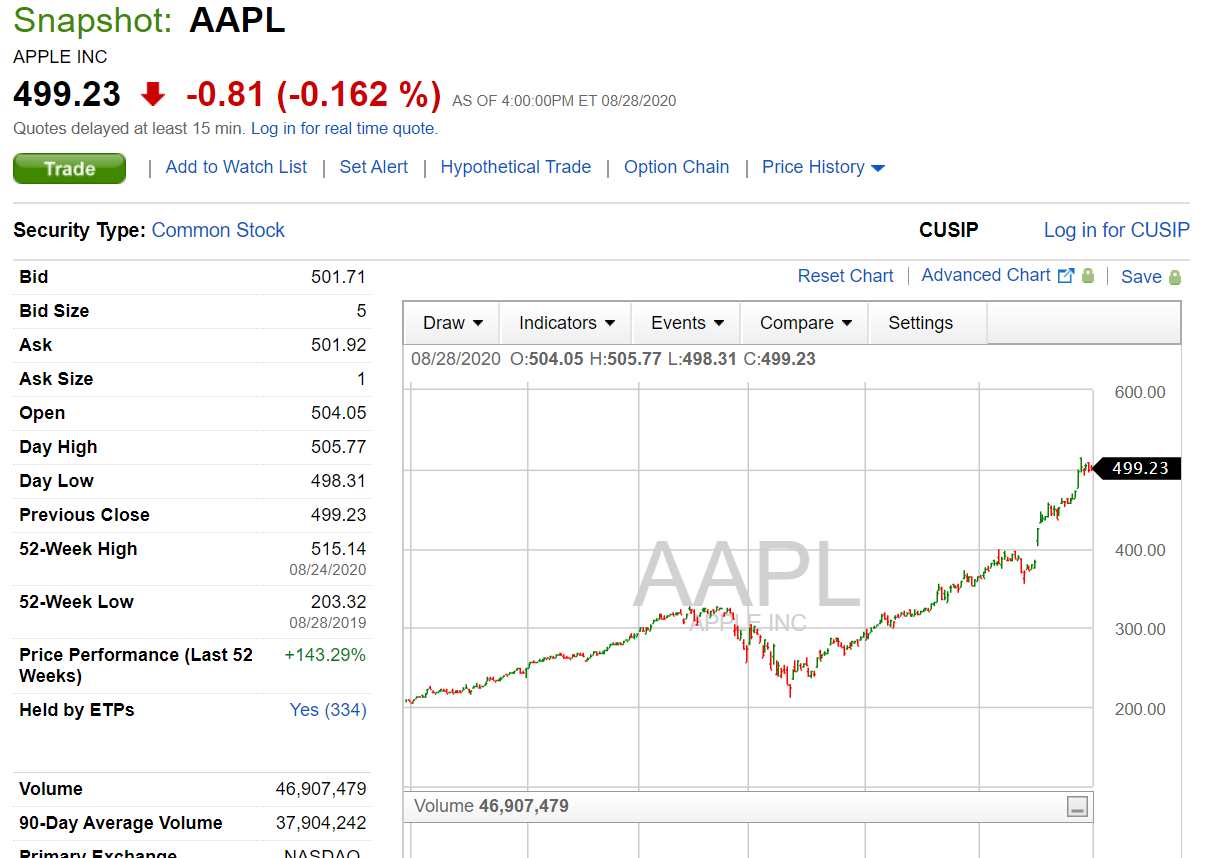

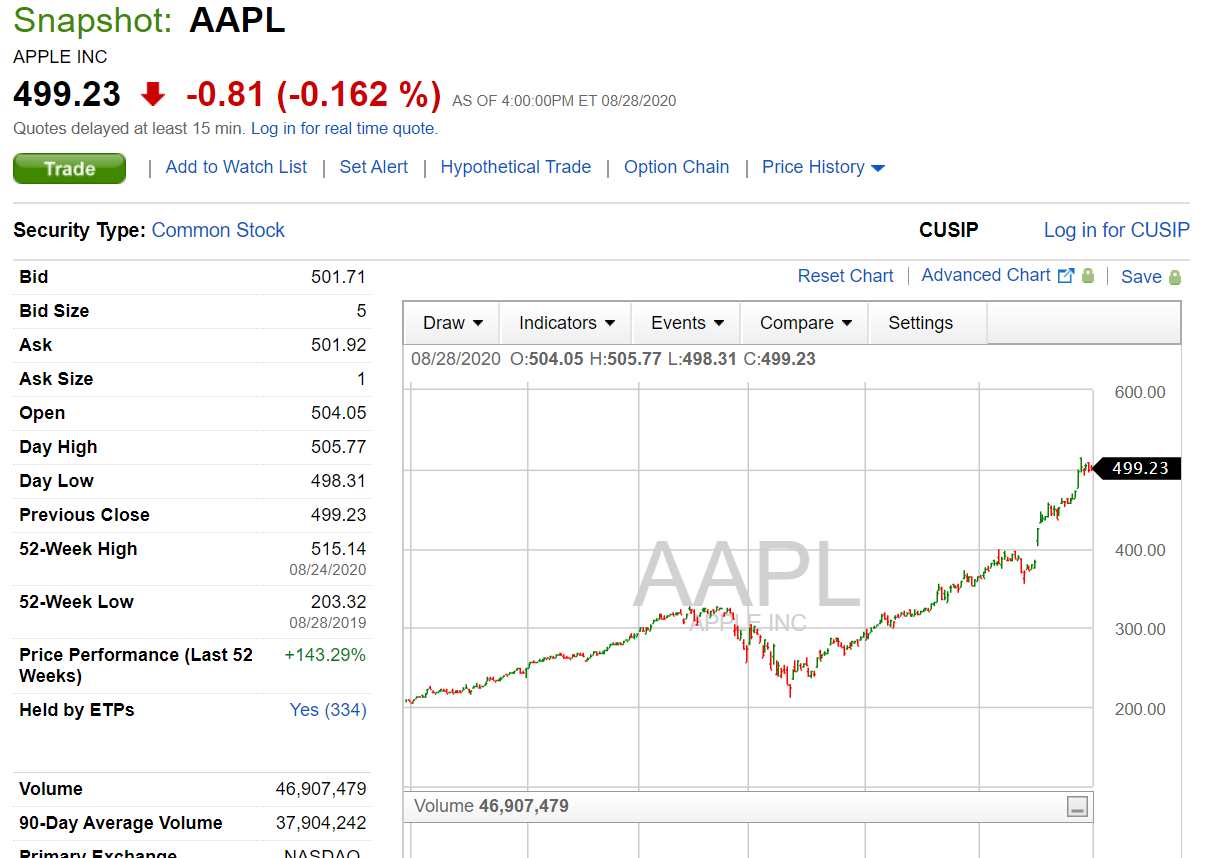

View/Download File: /project759_0325/Investments_Stock_companies_list_examples.pdf - Direct InstructionI will go to fidelity.com and show students how to look up stock prices.

I will walk them through reading the information on the detailed quote screen-Apple.

I will point out the ask price and explain the 52 week high and the 52 week low. -

- Guided PracticeThe class will choose one of the stock from the list and together we will look up the information on the graphic organizer.

-

View/Download File: /project759_0325/Detailed_Quote_sheet.pdf - Independent Practice/Differentiated ActivitiesStudents will then look up the ask price, 52-week high and 52 week low for all of their 15 stocks.

Accommodation and modification as needed: I will provide completed quote sheets to students and they will verify the information provided (they will understand that the ask price of the stock will be different as prices change continuous so they will update daily price) - Reflection on Employability SkillsStudents will analyze the information that they have recorded and begin to draw some conclusion about the overall performance of a stock.

They will determine if the stock has performed consistently over the course of a year based on the price per share. They will identify 8 stocks that they think they would buy based on this initial information.

* Evaluate how liquidity and volatility factor in the analysis of a growth investment - Lesson ClosureI will explain to students that this is just the surface level detail of what they should consider when deciding what stocks to buy.

I will explain how the volatility of a stock can have a major impact on their investment/portfolio.

Play the attached video for reinforcement.

https://www.youtube.com/watch?v=ZX7DZ-cJZ-I - Summative/end of lesson assessmentI will review students work and check for accuracy. This information will be used in next lesson to calculate gain and loss of a stock.

- References / Resources / Teacher PreparationPrinciples to investing https://www.youtube.com/watch?v=yRr0_gJ-3mI

Video on Volatility https://www.youtube.com/watch?v=ZX7DZ-cJZ-I

Lesson plans were authored based on the collective information and knowledge obtained through working with Plimoth Investment Advisors and BayBoast Bank https://www.plimothinvestmentadvisors.com/home/home

Lesson #3 | Calculate Gain Loss of a stock

- Lesson Plan 3 TopicCalculate Gain Loss of a stock

-

Web Link: What`s Diversification? | Fidelity - YouTube Web Link: What`s Diversification? | Fidelity - YouTube - Lesson Plan 3 ObjectivesStudents will be able to...

** Explain how to buy a stock

** Calculate the number of shares they can purchase with their initial investment

** Calculate the gain loss of a stock

** Understand the concept of a paper loss - Anticipatory set or lesson opening (to activate students` prior learning or draw student interest or involvement)Activator: Students will look up today`s prices for the 15 stocks they identified in prior day`s lesson. In different color in they will record the new price. Students will share out information on anything that they find unusual or very different.

I will have students facilitate the conversation and let them lead the analysis and inquiry

(5 stocks for students requiring accommodations) - Direct InstructionI will provide students`a blank Gain-Loss Graphic Organizer.

We will go to fidelity.com and look up today`s price-par price. I will walk them through how to first determine the number of shares they are able to buy based on the amount of money they have to invest. We will do this for Amazon, Target, and Pepsi.

Next I will provide them with a future price of each stock for the purpose of showing them how to calculate the gain or loss of each stock.

A completed sheet will be provided to students to meet accommodations. Students will be asked to take notes on the worksheets.

-

View/Download File: /project759_0325/STOCK_Gain_Loss_Guided_Practice_2020.pdf View/Download File: /project759_0325/STOCK_Gain_Loss_Template.pdf - Guided PracticeAll students will be look up TJX companies. They will record information on their template.

Once that is done I will give them a future price so they can calculate gain/loss.

After I check for understanding, I will release them to independent practice. - Independent Practice/Differentiated ActivitiesStudents` will look up the price of their 15 stocks that they identified in yesterday`s lesson. They will first look up the price of their stock as of January 2, 2020.

For the purpose of this simulated activity, students invested $10,000 in every company. -

View/Download File: /project759_0325/Stock_look_back_independent_work.pdf - Reflection on Employability SkillsI will ask students; Why is it important to continually calculate their investment position on each individual stock investment?

I will have them consider how and why their portfolio can shift?

They will be able to explain a paper loss. - Lesson ClosureMake connections to the potential volatility of stock investments.

Ask students to answer. How do you protect your investment from major loss?

Introduce concept of diversification and they need to buy wisely. Explain that it is important to conduct further analysis of a company before making large investments. Buying stock on sensationalism and market hipe may not be wise.

Students will watch the attached video.

https://www.youtube.com/watch?v=LU8tubkz_Fg - Summative/end of lesson assessmentTo ensure that students understand how to calculate the gain/loss they will be given a quiz.

Modification for students..only need to complete half -

View/Download File: /project759_0325/Stock_Assessment.pdf - References / Resources / Teacher PreparationFor extra credit create a stock market game which students can continue for the duration of the classs.

https://www.marketwatch.com/game

Video on Diversification https://www.youtube.com/watch?v=LU8tubkz_Fg

Lesson plans were authored based on the collective information and knowledge obtained through working with Plimoth Investment Advisors and BayBoast Bank https://www.plimothinvestmentadvisors.com/home/home

Lesson #4 | Students will unpack some of a company`s financial data to establish real value. - Lesson Plan 4 TopicStudents will unpack some of a company`s financial data to establish real value.

- Lesson Plan 4 ObjectivesStudents will be able to....

** Explain how to buy a stock

** Calculate the number of shares they can purchase with their initial investment

** Calculate the gain loss of a stock

** Understand the concept of a paper loss

- Anticipatory set or lesson opening (to activate students` prior learning or draw student interest or involvement)"Stocks start September in high gear as Apple and Tesla split, and markets await the August jobs report"

A current headline should be posted. This will activate a discussion about constant changing picture of a stock and a company. - Direct InstructionStudents will go to finviz.com.

We will look up Coca-Cola and identify EPS, dividends, forward P/E, EPS Next Y, EPS Next 5 Y, and Beta.

We will discuss each indicator and the importance to determining value of the stock.

Students will read the article from Forbes: Understanding the P/E Ratio to deepen their knowledge. -

View/Download File: /project759_0325/Stock_data_to_determine_value.pdf - Guided PracticeStudents will work in pairs and look up MacDonald`s corporate earnings

-

View/Download File: /project759_0325/Stock_data_to_determine_value.pdf - Independent Practice/Differentiated ActivitiesStudents will look up this indicators for their 15 stocks that they have identified at the start of this unit.

I will circulate around and check for understanding (non-covid environment).

Students will be working in teams so I will be able to check their work remotely.

Students will then choose one company that they want to focus on and begin their culminating project. I have provided an example of report format. This report outline will then be used to complete the qualitative research. -

View/Download File: /project759_0325/CoCaCola_Corproarte_Earnings_Guided_Pratice.pdf - Reflection on Employability SkillsHaving a comprehensive analytical perspective of investing in stocks will provide students will knowledge that will be incredible valuable to them once they begin financial planning.

Once they get their first job after college or after high school, they will have the opportunity to begin to invest for their future and retirement.

Understanding the long term benefit of investing small amounts of money over a long period of time are key concepts for students to learn at an early age. - Lesson ClosureStudents will look over their 15 stocks and start to identify stock that demonstrate value. While the price of the stock is an important factor when deciding whether or not to invest, understanding the larger financial position of the company is the compelling reason to choose one company`s stock over another.

- Summative/end of lesson assessmentStudents will write a summary based on the analysis of their research and new data.

They will identify a company`s price-to-earnings ratio, or P/E ratio, which will help them compare the price of a company’s stock to the earnings the company generates. This comparison will allow them to understand whether markets are overvaluing or undervaluing a stock. They will look at management`s execution and how they respond to current economic condition; such as unemployment data, consumer confidence, inflation etc. They will consider future trends and outlook based on what is happening in the world around us. For example, Covid-19 has forced many businesses to adapt to a "contact-less experience". Has the company been able to navigate the business and make swift changes? - References / Resources / Teacher PreparationArticle - Forbes how to understand the P/E Ratio https://www.forbes.com/advisor/investing/what-is-pe-price-earnings-ratio/

Finviz.com

Lesson plans were authored based on the collective information and knowledge obtained through working with Plimoth Investment Advisors and BayBoast Bank https://www.plimothinvestmentadvisors.com/home/home

Lesson #5 | Qualitative part of the company stock story to bring it full circle.- Lesson Plan 5 TopicQualitative part of the company stock story to bring it full circle.

- Lesson Plan 5 ObjectivesStudents will be able to.

* Conduct qualitative research on a company

* Synthesize information

* Write an Executive Summary about the company which includes Corporate Earnings; Industry/Business Summary, Economic Trends, Management Execution, and Valuation. - Anticipatory set or lesson opening (to activate students` prior learning or draw student interest or involvement)This lesson is expected to take 3 days.

We will visit Plimoth Investment Advisors webpage. Students will be asked to read most recent market commentary and record 3 interesting facts about the markets. Students will be released and asked to work with a partner (non-COvid envirnoment) and share ideas.

We will come together as whole group and pairs will each share out 1 idea.

Everyone will record information that they did not already identify to com up with a complete list.

This will stimulate id

Students will refer back to example I provided yesterday on Co-Ca-Cola. We will discuss the company`s performance and begin to put meaning to the financial data. -

Web Link: https://www.plimothinvestmentadvisors.com/home/home - Direct InstructionI will bring up the various sources and together we will read the various narrative(s) on Coca-Cola from multiple sources. We will look for trends and consistency which will provide support and rationale for the quantitative analysis.

Students will take notes and the goal is identify the catalyst that affects the stock either positively or negatively.

The main resource sites I will ask students to use are:

S & P Capital

Investor Relations, Coca-Cola

Bloomberg opinions

Morning Star

- Guided PracticeUsing the attached graphic organizer students will begin to record their information.

-

View/Download File: /project759_0325/Graphic_Org_Qualitative_Research.pdf - Independent Practice/Differentiated ActivitiesStudents will be released to work on their individual company report.

Their deliverable will be the report and presentation to the class.

**I will provide an template on Starbucks for students needing modification. The template will include sentence starters and bullets items. - Reflection on Employability SkillsDuring student presentations other class members will be taking notes and recording information. As a class we will vote on the top 5 stocks that we might consider investing in today.

This will facilitate analysis and inquiry even though perspectives may different. - Lesson ClosureStudents will have gained an appreciation for the complexity and excitement of the dynamic world of the stock market. They will also see the opportunity that exists and have learned that there is no get rich quick scheme.

Investing and building wealth is very possible but you must take an active role in understanding how to build a balanced portfolio to mitigate risk.

Lastly, they will have also learned about the various ways to get into the market. - Summative/end of lesson assessmentQuantitative and Qualitative Report.

Rubric provided.

Assessment for presentation provided. -

View/Download File: /project759_0325/Presenatation_rubric_stock_qual_and_quan_analysis.pdf View/Download File: /project759_0325/Rubric_for_stock_qualitative_quantitative_report.pdf - References / Resources / Teacher PreparationPlimoth Investment Advisors

Websites:

S & P Capital

Investor Relations, Coca-Cola

Bloomberg opinions

Morning Star

Lesson plans were authored based on the collective information and knowledge obtained through working with Plimoth Investment Advisors and BayBoast Bank

Recommended Strategies / Instructional Techniques - Reading StrategiesEvidence Based strategies:

Active reading included; Annotating, re-reading, questioning, summarizing

Close read performance criteria provided.

Analysis and inquiry strategies to check for understanding

Students asked to continually read market updates from Plimoth Investor Advisors (link provided in lesson).

Students must also conduct on-going market research hence continuous reading (all sources provide in lesson) - Multimedia/Visual Strategy (f.e. slides)All students will require the use of technology. I will ensure that they have a code for access should they need it.

PowerPoint Presentations

Video`s used to reinforce ideas and deepen understanding.

Microsoft teams is the platform used so continuous class dialogue an individual dialogue on-going. - Graphic organizers or handoutsGraphic Organizers provided in every lesson (attached in each lesson)

Vocabulary sheet provided for unit lesson. - Writing StrategiesStudents will be writing a Quantitative and Qualitative report on a company as their final assessment at the end of the unit plan (Sample writing piece report provided to students as a guide)

Taking notes

Students will write on I see it means organizer provided.

Final Unit assessment, students are given the opportunity to write and present analysis and summarization. (Rubric provided) - Speaking and Listening StrategiesThink write pair share in a standard norm in every class every day.

Performance criteria attached.

Students are asked to take notes during direct instruction (graphic organizers provided to help students organize information.

-

View/Download File: /project759_0325/Performance_criteria_Think_write_pair_share.pdf - Family: Any opportunities to involve parent/guardians and other family members in this project?Students will be encouraged to talk with their family and or guardians.

Students also highly encouraged to speak with their other teachers to begin a dialogue and build continuous interest in their learning.

- Virtual/Remote Teaching StrategyThis project was designed primarily for remote learning. Technology includes Microsoft Teams for class discussions, plus many videos and PowerPoint presentations.

Tags = Stock Analysis | Subject = Technology, CVTE, Other: Business Education | Grade Level = HS | Time Period = School Year | Program/Funding = | Externships-2020 |

Direct website link to this project: http://ContextualLearningPortal.org/contextual.asp?projectnumber=759.0325

|